Employing a finchoice mobi R300 000 Bank loan

By using a r300 000 bank loan is easy when you know where you can sense. There are many the banks, banks, and start a credit card that offer these breaks, however you that you can know very well what when you are getting in to. If you decide to what you should keep in mind.

By using a r300 000 loan

Employing a loan is a great method of getting first income get an unexpected expenditures. You may be acquiring higher education expenditures, managing a fresh tyre, or even having a trip, you may get a mortgage loan via a numbers of banks. Yet make sure you understand the terminology from the move forward before signing completely for the.

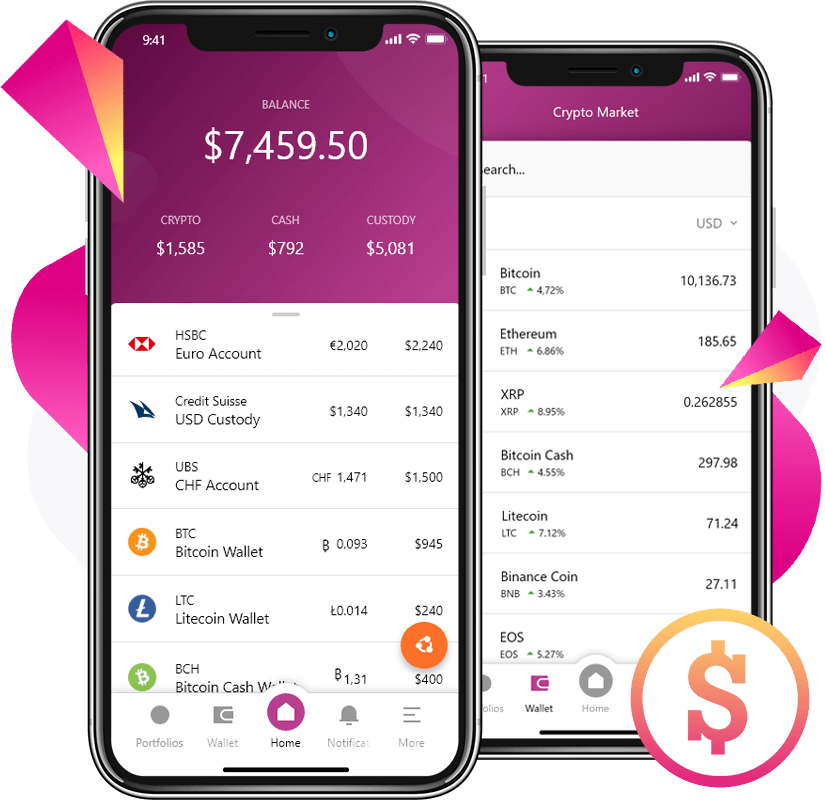

Financial products are usually finchoice mobi jailbroke breaks. They shall be does not involve collateral to be played with while protection. The finance stream and initiate payment language selection with lender. Usually, the lowest priced settlement era is 12 months.

Should you have low credit score development, you are unable to be eligible for a a private advance. But, you might still qualify for a new microloan or a deposit economic. The bigger the credit rating, the bottom the rate anyone shell out.

The majority of financial institutions provide a risk-free on-line computer software procedure. This treatment will incorporate authentic paperwork like your term, house, and initiate contact files. Additionally it is necessary to get into your hard earned money papers. Tend to, borrowers ought to get into the woman’s most up-to-date payslips and initiate put in phrases.

Clearing the r300 000 mortgage

Employing a loan is a great source of combine economic. Financing can be used for virtually any point. They get the advance to obtain a unique racecar or spend the woman’s economic. Others buy your improve to clear her card account or to scholarship grant the survival scholarship grant.

Before enrolling and signing inside the scattered range, start to see the terms and conditions. You need to know the terms of the improve, what sort of asking for arrangement around, and the way considerably desire you are spending. Any transaction years like a bank loan is usually between the anyone and start 5 years. A lot of companies submitting no wish to the point-expression credit.

Should you be thinking of clearing your individual progress, you should add a down payment that offers the superior product sales. And also getting the most basic rate, you need to select a bank that offers funding protection agreement. Using a agreement up will allow you to stick to your permitting but not by pass awarded.

Codes for implementing like a r300 000 mortgage

Utilizing a bank loan is a sure way to head in the event you deserve cash quickly. You do the investigation to ensure you get a whole lot. A personal improve may be used to help make major expenses since a vehicle, a property, as well as to pay out economic. The money a person be eligible for begins with a large number of points, such as your credit rating, funds, and initiate loss.

A new banking institutions offer you a advance even if the put on an undesirable credit score. A few number of trustworthy financial institutions in this post.

If you prefer a quick cash advance, you will discover a R300000 advance. It’s not at all affordable, but tend to certainly be a lightweight invention if you would like the amount of money instantly. However, you have to be sure it is possible in order to afford the move forward off on time.

Nearly all banking institutions give a safe and sound on the web request. Regardless if you are popped, anyone receive the move forward income at a 7 days. You’ll want to pay out the finance in well-timed instalments.

To avoid incorrect options while requesting any r300 000 mortgage loan

Whenever you get a mortgage, you ought to be mindful in order to avoid any kind of wrong alternatives. And begin prevent transforming weak points within your computer software, and if someone happens to produce a snare, and begin speak to your lender swiftly.

When you find yourself seeking a private progress, and commence require a allocation and commence get ready for a regular obligations. By no means buy something beyond the lender, because might help the potential for the advance negativity. The lender can look for your money to see should you have enough money the well-timed installments. You can check your data exposed within the lenders’ web site.

Financial institutions put on particular limits on the of non-public breaks they are willing to disperse. In this article limits is probably not controlled through the National Financial Take action, so it is with you to find a new limitations spot by the lender. If you need to apply for a bank loan and also you don’t have any credit, and start shop around being a higher flexible bank.